REFI

REdefining FInance

Real Estate & Energy Financing

What is REFI?

Better, better, and so much better!

REFI is our worldwide PE/funding program for real estate and energy projects.

Refi is designed to participate in high-end real estate projects and long-term energy investment plans, starting from seed capital raising, direct credit, or a JV partnership to make projects possible at lower rates than banks and without the excessive processes of private funds.

All financing programs are structured as joint participation schemes, where Roicè provides the majority of the funding (ranging from 60% to 90%), while the applicant covers the remaining 40% to 10%. This is backed by key financial institutions and offered through options such as JV partnerships, interest-only plans, or flexible lines of credit.

What type of projects we are looking for?

Looking the excellence

We only invest in the best. Projects must be financially sustainable and feasible, with a solid methodology and progress in the planning stages.

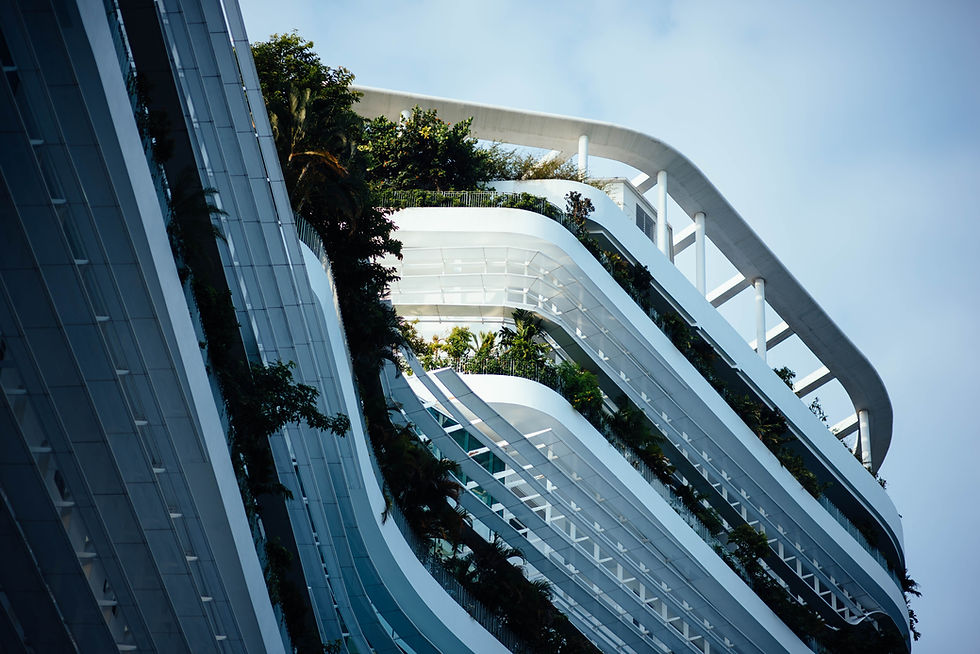

It doesn’t matter where they’re located; we can finance projects worldwide. From luxury residential developments, premium hotels, and unique experiences, to shopping centers, industrial warehouses, and energy development complexes (renewable and mixed). No matter what type of real estate project it is, we know how to get it done.

Advanced Tech

Refi is made up of one of the best and most experienced teams in real estate and energy mentorship, development, construction, and commercialization worldwide.

They’ve been involved in some of the most important global projects, and with the financial expertise and infrastructure of Fin-AI on your side, you couldn't be in better hands.

REFI

Products

*Some products are not available in some countries. Consult your manager.

JV transactions are focused on long-term projects that require significant investment, follow corporate transformation plans, and maintain a strong social and environmental responsibility agenda. This plan offers great advantages for the developer by reducing or even eliminating financial costs in exchange for equity in the project, which comes with incredible benefits.

The advantages of Roicè’s participation through its JV program include companies gaining substantial market and corporate value as a result of Roicè's mentorship and involvement. Developers also cut in half the amount of initial capital they need to provide, and from that point on, it’s all profit. Another benefit is the extended loan term, reduced or eliminated interest rates, and, in the case of international mixed-use resort complexes, Roicè (through Refi) can even originate mortgage financing for end buyers of condos, houses, vacation homes, and more.Roicè’s expertise in risk management and administration boosts returns and enhances market competitiveness, making Roicè a key ally that positions the developer as one of the leading players in the industry.

Joint Venture

CREDIT LINES

There are no limits to the best players

Credit lines are the best strategy for established or growing energy, real estate, and financial groups that require long-term funding to bring their key projects to life. These companies typically have liquid reserves and large projects in the pipeline, and Roicè can create a renewable and flexible long-term credit line with high revolving volumes. This allows companies to access nearly unlimited funds to support their consolidation.

How it works?

Refi creates a shared fund strategy where, depending on the amount placed by the client, Roicè establishes a line of credit for 18 months (or more). During this period, Roicè pays 20% (+ or -, depending on the project) of the funds placed in escrow monthly, with each payment settled over the long term (approximately 5 to 10 years, depending on the project and sector) at a highly competitive interest rate. The shared fund requires a minimum placement of €20 million for real estate projects and €35 million for energy projects.

DREAMS COME TRUE

Great IDEA

FUNDS

Roicè

(Bank)

Line of funds

Long Term Credit

Monthly exhibition

(%)

1. REFI is one product of Roicè and operates under EFI Capital USA, LLC, a company established in Delaware, USA.

2. Some products and/or services are excluded in some countries. The REFI products were designed to be allowed in the USA, European Union, Canada, Australia, Thailand, Hong Koing, Singapore, and South Africa.

3. REFI doesn't operate in Mexico and/or Latin America.

4. The availability of REFI products could sometimes be subject to the authorisation of some regulators. Consult your manager.